The 6 Things A Private Equity Firm Will Do After They Buy

Easily thing you can’t rather put your finger on private equity is in some way all over the location and no place at the exact same time. It’s elusive however you still find out about it over and over once again. You question: Exactly what is private equity?How does it work?And, does it have anything to do with me and my service? We’ll cover all that and more in The Ultimate Guide to Private Equity.

Private equity companies purchase stakes in private business with the hope of making an earnings by later selling those stakes for more than was at first invested. Private equity firms have a “buy low, grow quick, sell high” strategy. It resembles the stock exchange however rather of stocks in public businesses, private equity companies trade ownership stakes in private organisations. It’s in fact pretty simple to respond to. Private equity investors manage their portfolio companies. Hedge funds do not. Private equity investors deal with portfolio companies over the long-run, often 5-8 years. Hedge funds investments can be as short as a couple of weeks. Private equity also provides you the ability to work closely with the business over a prolonged time period.

The business usually opens its books and let the investors evaluate all aspects of its operations. Hedge funds investors, on the other hand, can only do their research study based upon public details. Private equity investors need to go through a deal-making process. private equity fund. Hedge funds investors can just purchase stocks with a click of a button.

Similar to the way you would address “why not hedge funds”, you must frame your action based upon these distinctions. Private equity invests in established companies with a proven track record. Whereas VC’s buy early-stage business. Due to the fact that equity capital purchases early-stage business, these financial investments have greater possibilities of failure. tens millions dollars.

Many will stop working, but all they need is one business to be a home-run, which one successful financial investment will bring the fund. Private equity companies often obtain the whole enterprise. Equity capital firms acquires only a part of the equity ownership. Private equity financial investments generally involve financial obligation funding. Financial obligation financing typically comprise over 50% of the total funding sources.

Coronavirus’s Impact On Private Equity – Mckinsey

Private equity offers are much more prolonged and intricate than venture capital offers. Private equity firms invest throughout all markets. Equity capital investments are mainly assigned to tech companies or tech-enabled organisations. This is an uncommon follow-up but simple to deal with – tysdal business partner. Fund of funds typically purchase private equity funds however they can sometimes also co-invest with private equity companies in LBO offers.

So the recruiter is asking why not go to a fund of fund, where you’ll likewise be able to buy business. You find out to analyze not only standard business, but likewise private equity companies too. But the catch here is that evaluating business opportunities is not their specialty.

They’ll be the one that coordinate all the due diligence work streams, arranging financial obligation financing with the banks, and so on. They are at the frontline of the work and pass their diligence findings to the fund of funds – pay civil penalty. It’s uncommon to see a fund of fund lead a private equity deal.

Initially, you can state that you’re more thinking about purchasing corporations rather than funds. Second, you can say that you wish to operate in private equity because you’ll get much more exposure to the offer process. Third, you can say that you desire to be actively included with post-investment functional work.

Remember to stay concise and prevent being long-winded. Also, do not copy the “why private equity” examples above word-for-word. Spend a long time to tailor it to your own background and interests. While you must have the ability to get this question right to advance in the process, you do not need to go overboard to develop a distinct answer.

The 6 Things A Private Equity Firm Will Do After They Buy

Particular funds can have their own timelines, financial investment goals, and management philosophies that separate them from other funds held within the same, overarching management firm. Effective private equity firms will raise numerous funds over their life time, and as firms grow in size and complexity, their funds can grow in frequency, scale and even specificity. To find out more about private equity and also - visit the blogs and -.

Prior to founding Freedom Factory, Tyler Tysdal handled a development equity fund in association with numerous celebs in sports and entertainment. Portfolio business Leesa.com grew quickly to over $100 million in earnings and has a visionary social objective to “end bedlessness” by donating one bed mattress for each 10 offered, with over 35,000 contributions now made. Some other portfolio companies remained in the industries of wine importing, specialty financing and software-as-services digital signage. In parallel to managing possessions for businesses, Tyler Tysdal was managing private equity in real estate. He has had a variety of successful personal equity investments and numerous exits in trainee housing, multi-unit housing, and hotels in Manhattan and Seattle.

Instead, focus on how to think like an investor and how to talk recruiters through a deal. We are a little group made up of former investment banking professionals from Goldman Sachs and financial investment professionals from the world’s top private equity firms and hedge funds, such as KKR, TPG, Carlyle, Warburg, D.E.

Our mission is to cultivate the next generation of leading skill for Wall Street and to assist prospects bring their professions to brand-new heights – securities fraud theft. We’re based in the United States, however we have competence throughout Europe and Asia too.

By: Mark Gaeto Handling Partner, Conrad Olenik AssociateHow does the CEO of a private firm grow and build a terrific business? What does it consider CEOs to cultivate brand-new earnings enhancement chances and jump-start future growth that shareholders can harvest?Sometimes it takes more than a wise method or solid management group to construct fantastic firms. carter obtained $.

Capital fuels growth, and having access to capital is key. What are a few of the paths to capital, and how do you set about identifying the correct amount? Let’s have a look at figuring out the amount of capital and protecting it from private equity firms. If you own a successful and mature firm that is cash-flow positive, you have lots of choices to money development.

Numerous factors affect your options to fund growth, including your firm’s vision, strategic strategies, management group, financial health, client base, competitive positioning, cash-flow steadiness, market conditions, and other elements of business. The most critical aspect in identifying your ideal mix of debt versus equity financing is the consistency and certainty of your money circulation.

Private Equity Definition, Companies, Pros & Cons

Think huge. Figure out not only the capital required for current operations, however likewise for growth efforts that will drive extra expansion both naturally and through acquisitions. Discover a skilled financial investment lender to develop out a looked into and detailed financial design and projection – loans athletes sports. The compromise in between equity and financial obligation funding has to do with risk and expense.

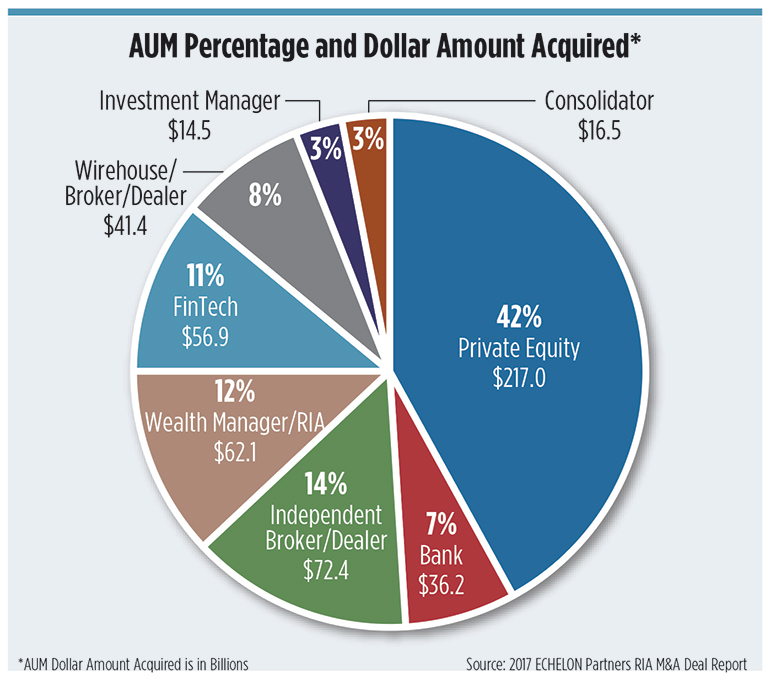

There are several types of private equity firms, in a range of shapes and sizes, based on their fund size and financial investment requirements. Normally, for companies searching for capital, the most suitable private equity funds are: leveraged buyout funds, growth equity funds, equity capital funds, financial obligation, and other kinds of funds.

Private equity investments not just instill capital into the firm, however they also buy out owners completely or partly. Development equity funds purchase companies with some level of growth and with EBITDA levels of $2-3 million and above. They look for mid- to late-stage or mature businesses that are wanting to scale operations to broaden sales and marketing efforts, introduce brand-new items, get in new markets or locations, and even fund acquisitions.